For high returns on cryptocurrency lending platforms, consider Aave, Compound, dYdX, and Balancer. These platforms offer competitive rates and trusted services that can help maximize your investments.

Are you looking to earn passive income on your cryptocurrency holdings through lending platforms? You might be curious about the potential returns and benefits these platforms offer. In the competitive world of digital assets, knowing which platforms provide the highest returns and reliable services is essential for any investor.

Let’s explore some of the top cryptocurrency lending platforms known for their high returns and secure lending practices.

Understanding Cryptocurrency Lending Platforms

Cryptocurrency lending platforms have emerged as a popular investment avenue, offering the potential for high returns. These platforms allow individuals to lend their cryptocurrency holdings to borrowers in exchange for interest payments. Understanding how cryptocurrency lending works and the potential returns it offers is essential for investors looking to capitalize on this opportunity.

What Is Cryptocurrency Lending?

Cryptocurrency lending refers to the practice of lending digital assets, such as Bitcoin or Ethereum, to individuals or institutions in exchange for interest payments. It allows cryptocurrency holders to earn passive income by leveraging their holdings without the need for active trading.

How Do Cryptocurrency Lending Platforms Work?

Cryptocurrency lending platforms act as intermediaries, connecting lenders with borrowers. Lenders deposit their digital assets onto the platform, and borrowers can then request loans using these assets as collateral. The platform facilitates the loan agreement and ensures repayment, while lenders receive interest payments on their deposits.

Maximizing Returns On Cryptocurrency Lending

Maximize returns on cryptocurrency lending with top-performing platforms for high yields. Earn from your crypto holdings effortlessly. Earn lucrative returns with trusted platforms like Aave, Compound, dYdX, and more.

Earning High Returns

When engaging in cryptocurrency lending, earning high returns is a top priority for investors. Utilizing platforms that offer attractive interest rates can significantly boost your earnings in the cryptocurrency space.

Factors Influencing Returns

Several factors influence the returns you can earn through cryptocurrency lending. These include market conditions, the type of cryptocurrency being lent, platform fees, and the duration of the lending period.

By understanding these factors, investors can make informed decisions to maximize their returns and optimize their lending strategies in the volatile cryptocurrency market.

Top Cryptocurrency Lending Platforms

Looking for cryptocurrency lending platforms with high returns? Discover the top lending platforms offering lucrative returns on your digital assets, including Aave, OKX, and Nexo. With low-interest rates, flash loans, and attractive terms, these platforms provide profitable opportunities for crypto lending.

Aave

Aave is one of the oldest and most trusted cryptocurrency lending platforms in the decentralized finance (DeFi) space. It offers various types of crypto loans, allowing users to take advantage of their crypto holdings. With Aave, you can enjoy low-interest loans and even access flash loans to seize arbitrage opportunities.

Compound

Compound is another popular decentralized cryptocurrency lending platform. It utilizes smart contracts to automate the lending and borrowing process. Through Compound, users can borrow and lend a wide range of cryptocurrencies, including Bitcoin and Ethereum. The platform offers competitive interest rates and provides a seamless experience for users.

Nexo

Nexo is a crypto lending platform that enables users to earn money from their crypto holdings. It offers attractive interest rates and favorable loan terms. Nexo also prioritizes security, ensuring that your assets are well-protected. Whether you’re looking to borrow or lend, Nexo provides a reliable and convenient platform for your cryptocurrency lending needs.

Binance

Binance, a leading cryptocurrency exchange, also offers a lending platform. With Binance Lending, users can earn passive income by lending their cryptocurrencies to other users. The platform provides competitive interest rates and supports a wide range of cryptocurrencies. Binance ensures a secure and user-friendly experience, making it a popular choice among crypto lending enthusiasts.

Credit: www.bitget.com

Types Of Crypto Loans

When it comes to cryptocurrency lending platforms, there are two main types of crypto loans available: collateralized loans and non-collateralized loans. Each type has its own unique features and benefits, allowing borrowers to choose the option that best suits their needs. Let’s take a closer look at these two types of crypto loans:

Collateralized Loans

Collateralized loans are the most common type of crypto loans. In this type of loan, borrowers are required to provide collateral, which is typically in the form of another cryptocurrency. The collateral serves as security for the lender and helps mitigate the risk associated with lending. If the borrower fails to repay the loan according to the agreed terms, the lender has the right to liquidate the collateral to recover their funds.

Collateralized loans offer several advantages for borrowers, including:

- Better interest rates: Since collateral reduces the lender’s risk, borrowers can often secure loans at lower interest rates compared to non-collateralized loans.

- Higher loan amounts: With collateral, borrowers can usually access higher loan amounts, allowing them to meet their financial needs more effectively.

- Flexible repayment terms: Lenders may offer flexible repayment options for collateralized loans, giving borrowers more control over their repayment schedule.

Non-collateralized Loans

Non-collateralized loans, also known as unsecured loans, do not require borrowers to provide collateral. Instead, these loans are approved based on the borrower’s creditworthiness and reputation within the cryptocurrency community. Non-collateralized loans are typically offered by peer-to-peer lending platforms, where lenders and borrowers directly interact.

Non-collateralized loans have their own set of benefits:

- No risk to collateral: Borrowers do not have to worry about their collateral being liquidated if they are unable to repay the loan.

- No need for existing cryptocurrency holdings: Non-collateralized loans are suitable for individuals who do not have enough cryptocurrency to offer as collateral.

- Faster approval process: Since the lending decision is primarily based on creditworthiness, non-collateralized loans are often approved more quickly.

It’s important to note that non-collateralized loans usually come with higher interest rates compared to collateralized loans. This is because lenders take on more risk by offering loans without any form of security.

In conclusion, both collateralized and non-collateralized loans have their own advantages and considerations. Borrowers should carefully evaluate their financial situation and risk tolerance before deciding which type of crypto loan to pursue.

Factors To Consider When Choosing A Crypto Lending Platform

Crypto lending platforms offer investors an enticing opportunity to earn high returns on their cryptocurrency holdings. However, not all platforms are created equal, and it is crucial to consider certain factors before choosing a crypto lending platform. In this article, we will explore three key factors that can help you make an informed decision: interest rates, loan terms, and security measures.

Interest Rates

Interest rates play a significant role in determining the profitability of lending your cryptocurrency. When evaluating a platform, look for competitive interest rates that can maximize your earnings. Compare the rates offered by different platforms to identify the most lucrative options. It’s important to remember that higher interest rates can come with increased risk, so make sure to assess the platform’s credibility and reputation as well.

Loan Terms

The loan terms offered by a crypto lending platform can greatly impact your experience as a lender. Consider factors such as loan duration, minimum and maximum loan amounts, and flexibility in loan management. A platform that offers flexible loan terms allows you to customize your lending strategy according to your needs and preferences. Additionally, check for any fees associated with loan origination and repayment, as these can eat into your overall returns.

Security Measures

Security is of utmost importance when dealing with cryptocurrencies. Look for platforms that prioritize robust security measures to protect your assets. This includes measures such as cold storage of funds, two-factor authentication, and encryption protocols. A platform that has a strong track record in terms of security will provide you with peace of mind, knowing that your cryptocurrencies are safe from potential threats.

When choosing a crypto lending platform, it is essential to consider factors such as interest rates, loan terms, and security measures. By carefully evaluating these factors, you can select a platform that offers high returns while ensuring the safety and flexibility of your investments. Remember, thorough research and due diligence go a long way in making the right choice.

Comparing Cefi And Defi Lending Platforms

When it comes to investing and earning returns on cryptocurrencies, lending has become one of the most popular avenues. With the rise of decentralized finance (DeFi) platforms, users now have access to lending options that offer potentially high returns compared to traditional centralized finance (CeFi) platforms.

Advantages Of Cefi Platforms

CeFi lending platforms are operated by centralized financial institutions, such as banks or lending companies. The advantages of CeFi platforms include:

- Regulation: CeFi platforms are often regulated by government authorities, providing a sense of security for investors.

- Insurance: Some CeFi platforms offer insurance coverage for deposited funds, safeguarding against potential losses.

- User-Friendly Interface: CeFi platforms usually have intuitive user interfaces, making it easier for beginners to navigate the lending process.

Advantages Of Defi Platforms

DeFi lending platforms, on the other hand, operate in a decentralized manner, often utilizing smart contracts and blockchain technology. The advantages of DeFi platforms include:

- Transparency: DeFi platforms are transparent, as all transactions are recorded on the blockchain, providing users with full visibility.

- Accessibility: DeFi lending is open to anyone with an internet connection, eliminating traditional barriers to entry.

- High Returns: DeFi platforms have the potential to offer higher returns on investments compared to CeFi platforms due to the absence of intermediaries.

Risks And Challenges In Crypto Lending

Cryptocurrency lending platforms offer the allure of high returns, but they come with their own set of risks and challenges that borrowers and lenders need to be aware of. From volatile market conditions to regulatory hurdles, navigating the world of crypto lending requires careful consideration and risk management.

Volatility Risk

The cryptocurrency market is notorious for its volatility, with prices capable of fluctuating wildly in a short span of time. This poses a significant risk to crypto lending, as the value of the collateral used to secure loans can quickly diminish, putting lenders at risk of loss. It’s crucial for both borrowers and lenders to consider the potential impact of market volatility on their lending activities and employ risk mitigation strategies to mitigate potential losses.

Regulatory Challenges

Crypto lending operates in a regulatory grey area, with laws and regulations varying widely across different jurisdictions. This regulatory uncertainty can create challenges for both lenders and borrowers, as they navigate legal compliance and regulatory requirements. Lenders must be mindful of the evolving regulatory landscape and take proactive steps to ensure compliance, while borrowers need to be aware of the potential legal implications of engaging in crypto lending activities.

Credit: m.facebook.com

Future Of Cryptocurrency Lending

Cryptocurrency lending platforms are revolutionizing the financial landscape with their high returns and innovative solutions. The future of cryptocurrency lending holds promising trends and potential impacts on traditional finance.

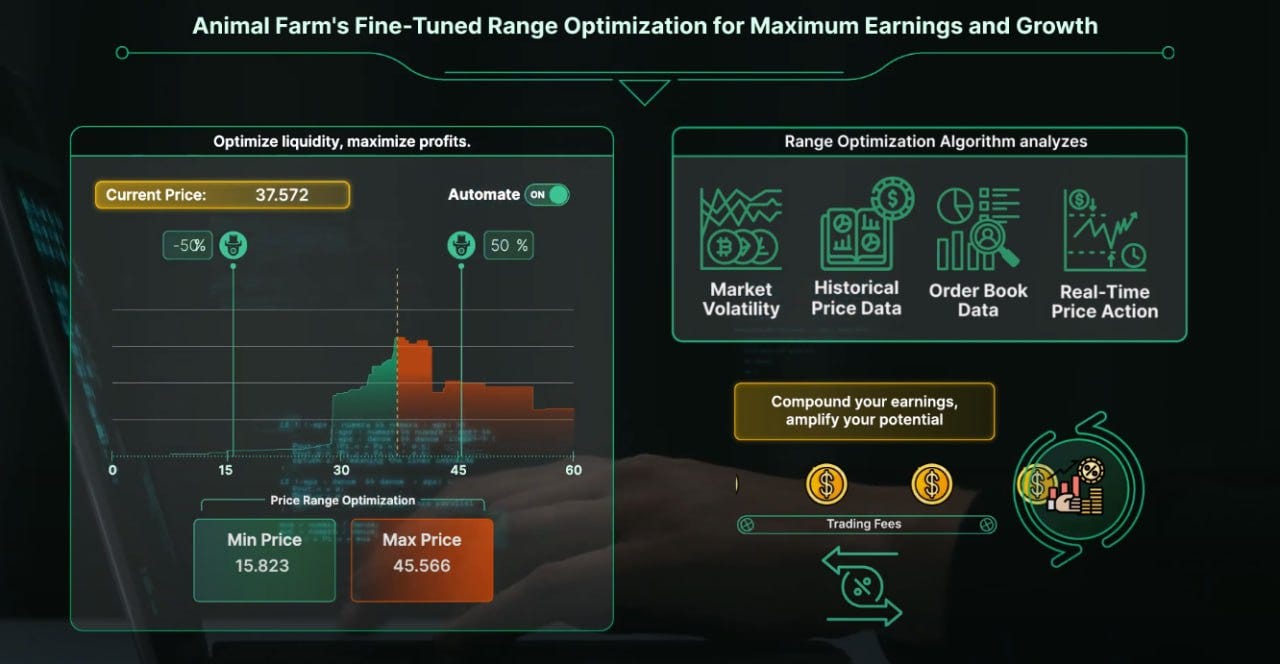

Trends And Innovations

The cryptocurrency lending sector is witnessing rapid growth fueled by technological advancements. Platforms like Aave, Compound, and dYdX are introducing innovative features such as flash loans and automated smart contracts.

Potential Impact On Traditional Finance

Cryptocurrency lending platforms have the potential to disrupt traditional financial institutions by offering higher returns and faster transactions. With lower interest rates and increased security, these platforms are attracting both individual and institutional investors.

Credit: medium.com

Frequently Asked Questions On “cryptocurrency Lending Platforms With High Returns”

What Are The Returns On Crypto Lending?

Crypto lending offers high returns through competitive interest rates, providing an opportunity for profit. Various platforms, like Aave, Compound, and Binance, offer attractive annual percentage yields (APY) for staking and lending. Researching and choosing the right platform is vital for maximizing returns on crypto lending.

Which Cryptocurrency Has The Highest Return?

Cryptocurrency with the highest return varies. Research crypto lending platforms like Aave, Nexo, and Binance for the best rates.

Is Crypto Lending Profitable?

Crypto lending can be profitable with high returns. Consider reputable platforms for potential earnings.

What Is The Interest Rate On Crypto Lending Platforms?

Crypto lending platforms offer varying interest rates depending on the platform. Rates can range from as low as 1% to as high as 12% or more. It’s important to research and compare different platforms to find the best interest rate for your crypto lending needs.

Conclusion

Dive into the world of high-return cryptocurrency lending platforms now for lucrative opportunities that await. Explore trusted platforms like Aave, Compound, dYdX, and more. Discover low-interest loans and seamless automation for a rewarding crypto lending experience. Maximize your earnings with these innovative financial solutions.