Security tokens represent ownership or profit rights, while utility tokens grant access to platform services or products. Security tokens offer ownership or profit rights, while utility tokens provide access to platform services or products.

In the realm of blockchain and cryptocurrency, understanding the distinction between security tokens and utility tokens is crucial for investors and developers alike. Security tokens are digital assets that give investors ownership rights or entitlement to profits from a real-world asset, offering a form of investment vehicle.

On the other hand, utility tokens are tokens that provide access to a specific service or product within a blockchain platform, serving as a means of transaction or access. Both types of tokens play distinct roles in the digital asset ecosystem, with security tokens emphasizing investment opportunities and utility tokens facilitating platform usage.

Understanding Security Tokens

In the world of cryptocurrency and blockchain, security tokens represent a significant evolution. Understanding the key differences between security tokens and utility tokens is crucial for investors and entrepreneurs venturing into the blockchain space. Security tokens hold great potential for reshaping traditional financial markets and creating new investment opportunities.

Investment Focus

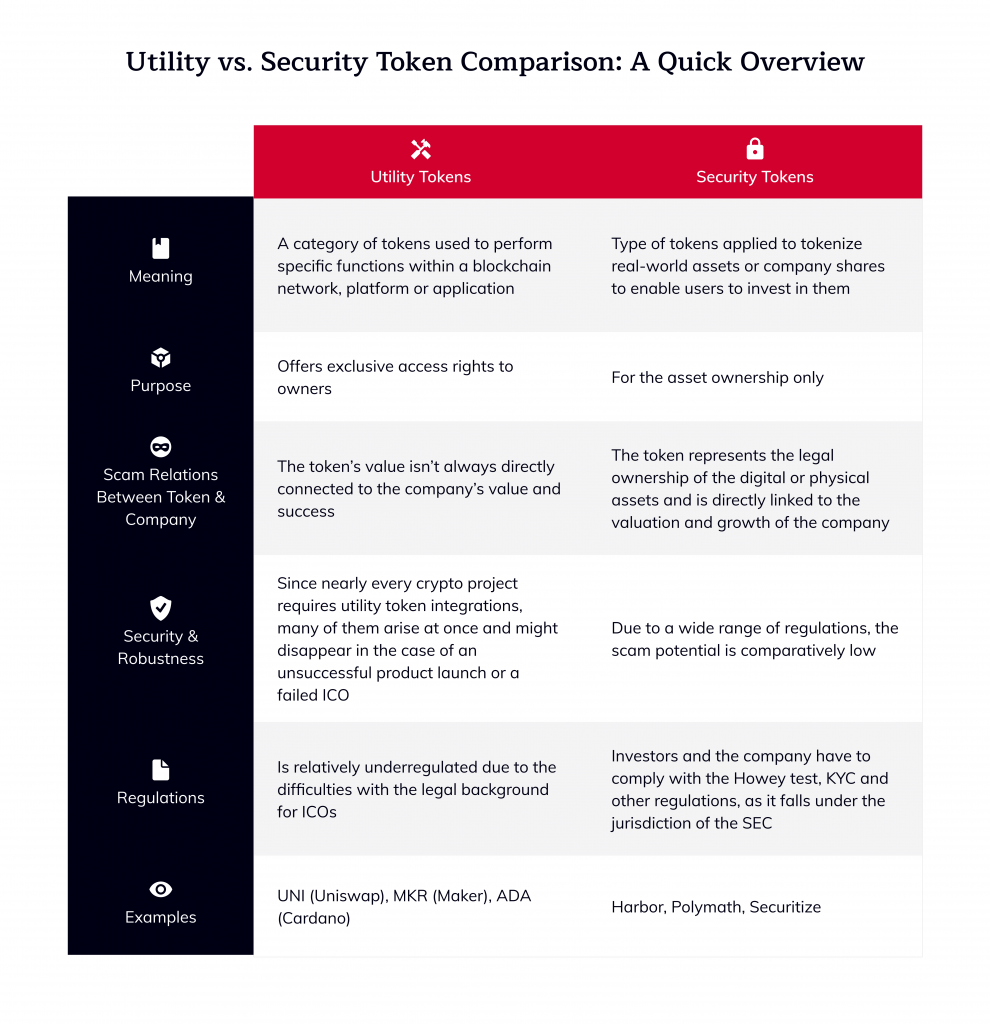

Security tokens are distinct from utility tokens in that they primarily serve as investment vehicles. When investors purchase security tokens, they are acquiring ownership or profit rights in a real-world asset, such as real estate, company shares, or revenue streams. In contrast, utility tokens are designed to provide access to specific services or products within a platform or ecosystem. This fundamental difference in investment focus shapes the nature and purpose of these token types.

Value Source

The value of security tokens is intrinsically linked to the performance of the underlying real-world assets. This means that investors holding security tokens stand to gain or lose based on the success or failure of the associated asset. Real estate security tokens, for example, derive their value from the rental income or property appreciation. On the other hand, utility tokens derive their value from the demand for the services or products offered within the platform, creating a different valuation dynamic.

Credit: ideasoft.io

Understanding Utility Tokens

Access Focus

Utility tokens primarily focus on providing users access to specific services or products within a platform. Unlike security tokens that represent ownership or profit rights, utility tokens serve as a means of accessing functionalities or features offered by a company.

Value Source

Utility tokens derive their value from the demand for the services or products they enable access to. The value of utility tokens is intrinsically tied to the utility or usefulness they offer within the ecosystem. This value is driven by the adoption and utilization of the platform by its users.

Distinguishing Features

Security tokens and utility tokens are two distinct types of tokens with key differences. Security tokens are investment vehicles that offer ownership or profit rights, while utility tokens provide access to a service or product within a platform. The value of security tokens is often tied to the performance of real-world assets.

Ownership Vs. Access

Security tokens and utility tokens have distinct features that set them apart. One key difference lies in the concept of ownership versus access. Security tokensownership or profit rights. These tokens are designed to represent ownership in a company, asset, or project. Holders of security tokens have a stake in the underlying asset and are entitled to certain rights and benefits, such as voting rights and dividend distributions. Essentially, security tokens are like digital securities, providing investors with a means to participate in the potential financial growth of an asset. On the other hand, utility tokensaccess to a service or product within a platform. These tokens are typically used as a form of currency within a specific ecosystem or network. Unlike security tokens, utility tokens do not grant ownership rights. Instead, they serve as a means to access and utilize specific features or services offered by the project or platform. So, while security tokens offer ownership or profit rights, utility tokens provide access to services or products within a platform. The distinction between ownership and access is crucial in understanding the underlying purpose and value proposition of these tokens.Real-world Asset Relation

Another important distinction between security tokens and utility tokens is their relationship to real-world assets. For security tokens, their value is directly linked to the performance and underlying assets of the project or company they represent. This means that the value of a security token may fluctuate based on the success, profitability, or market conditions of the associated asset. These tokens provide investors with an opportunity to invest in assets that were previously inaccessible or illiquid. They bridge the gap between traditional investment markets and the blockchain world. On the contrary, utility tokens do not have a direct correlation to real-world assets. Instead, their value relies on the demand and utility within the platform or ecosystem they are associated with. Utility tokens are created to provide users with access to specific services, products, or features. As the popularity and usage of the platform increase, the demand for these tokens may grow, potentially driving their value higher. However, it’s important to note that utility tokens do not represent ownership of any underlying asset. In summary, security tokens derive their value from the performance of real-world assets, while utility tokens are valued based on their utility within a particular platform or ecosystem. Understanding this distinction is essential for investors and users alike to make informed decisions in the world of token economics.

Credit: www.linkedin.com

Regulatory Environment

In the regulatory environment, Security Tokens differ from Utility Tokens in their primary purpose. Security Tokens offer ownership or profit rights, while Utility Tokens grant access to products or services within a platform. The value of Security Tokens is linked to real-world asset performance.

Since the issuance of tokens can have implications under various regulatory frameworks, it is crucial to understand the different regulations governing security tokens and utility tokens.Security Token Regulations

Security tokens are subject to stringent regulations as they are considered financial securities. They must adhere to securities laws and regulations, such as registration requirements with relevant financial authorities. Compliance with these regulations provides investors with transparency and protection.- Security tokens are regulated under securities laws.

- Must comply with registration requirements.

- Regulations provide transparency and investor protection.

Utility Token Regulations

Unlike security tokens, utility tokens do not represent ownership or profit rights. As a result, they are subject to less stringent regulations. However, regulatory bodies are increasingly focusing on utility token offerings to prevent fraud and protect investors.- Utility tokens are not considered financial securities.

- Regulations are less stringent compared to security tokens.

- Regulatory bodies are enhancing scrutiny on utility token offerings.

Market Adoption

Security tokens and utility tokens have key differences in market adoption. Security tokens represent ownership or profit rights, while utility tokens provide access to a product or service within a platform. Understanding these distinctions is crucial for investors navigating the world of tokenized assets.

Security Tokens: Market Adoption

In recent years, the cryptocurrency market has witnessed a significant shift with the emergence of security and utility tokens. The market adoption of these tokens has become a subject of great interest for investors and blockchain enthusiasts. In this section, we will explore the market adoption of security tokens and shed light on their key characteristics and benefits. Security tokens are investment vehicles that offer ownership or profit rights to investors. These tokens are typically issued through Initial Coin Offerings (ICOs) or Security Token Offerings (STOs) and are subject to regulatory oversight. Unlike utility tokens, security tokens are designed to provide investors with ownership in a company, real estate, or other tangible assets.Utility Tokens: Market Adoption

On the other hand, utility tokens are primarily used to access a specific product or service within a blockchain platform. These tokens are not intended to be used as investment vehicles. Instead, they enable users to participate in the platform’s ecosystem and benefit from its functionalities. Utility tokens have gained popularity among startups, particularly those in the blockchain and decentralized finance (DeFi) space. These tokens often serve a specific purpose within a network, such as granting access to certain features or services, facilitating transactions, or rewarding users for their engagement.Comparing Market Adoption

When it comes to market adoption, security and utility tokens have different dynamics. Security tokens have gained traction among traditional investors who are looking for regulated investment opportunities in the crypto space. The appeal of security tokens lies in their ability to represent ownership or profit rights in real-world assets, making them attractive to institutional investors who seek exposure to tangible assets. Utility tokens, on the other hand, have seen widespread adoption within decentralized platforms and have become an integral part of the blockchain ecosystem. These tokens have fueled the growth of various decentralized applications (dApps) and have been instrumental in facilitating transactions and incentivizing user participation. In conclusion, while security tokens and utility tokens both contribute to the evolution of the crypto market, their market adoption differs significantly. Security tokens offer investment opportunities in real-world assets, appealing to traditional investors, while utility tokens drive the growth of decentralized platforms and enable users to participate in their ecosystems.Challenges And Opportunities

In the world of cryptocurrencies, the debate between security tokens and utility tokens has been a topic of interest. Understanding the key differences between these two types of tokens can shed light on the challenges and opportunities that come with each. Let’s delve into the distinct features of security tokens and utility tokens to uncover the potential they hold in the ever-evolving landscape of digital assets.

Security Tokens

Security tokens represent a digitized form of traditional securities such as stocks, bonds, and real estate. They are subject to federal securities regulations and derive their value from external, tradable assets. By bridging the gap between traditional financial markets and blockchain technology, security tokens offer improved liquidity and accessibility to a wider investor base.

Utility Tokens

Utility tokens, on the other hand, are designed to provide access to a specific product or service offered by a company. They are not intended as investments, but rather as a means of accessing a platform or ecosystem. Utility tokens are integral to the functioning of decentralized applications and can be used for various purposes, including voting rights, access to features, or discounts on services.

Now, let’s explore the challenges and opportunities associated with security tokens and utility tokens.

Security tokens present the challenge of complying with a complex regulatory landscape, which can lead to higher initial costs and longer issuance timelines. However, they also offer the opportunity to fractionalize ownership of high-value assets, thereby democratizing investment opportunities and unlocking liquidity in traditionally illiquid markets.

Utility tokens face the challenge of proving their intrinsic utility and maintaining demand within the ecosystem they are associated with. Conversely, they offer the opportunity to innovate decentralized business models, incentivize user participation, and create vibrant communities around blockchain-based platforms.

Future Outlook

Future Outlook:

As the crypto market continues to evolve, the future outlook for security tokens and utility tokens is filled with potential opportunities and challenges. Emerging trends and potential impacts on the market are essential considerations for investors and businesses looking to leverage blockchain technology effectively.

Emerging Trends

One of the emerging trends in the cryptocurrency landscape is the increasing interest in security tokens as a regulated investment option. With the potential to bring traditional assets onto the blockchain, security tokens offer a new level of transparency and liquidity. This trend is likely to lead to more institutional adoption and regulatory clarity in the future.

Potential Impact

The potential impact of security tokens and utility tokens on the financial industry is significant. Security tokens could revolutionize the way traditional assets are traded, bringing efficiency and accessibility to capital markets. On the other hand, utility tokens could transform the way digital products and services are accessed and monetized within blockchain ecosystems, creating new business models and revenue streams.

Credit: www.solulab.com

Frequently Asked Questions On “security Tokens Vs Utility Tokens: Key Differences”

What Is The Primary Purpose Of Security Tokens?

Security tokens serve as investment vehicles, providing ownership or profit rights to investors. Their value is often tied to the performance of real-world assets.

How Do Utility Tokens Differ From Security Tokens?

Utility tokens, unlike security tokens, provide access to specific services or products within a platform. They are not designed as investment vehicles but rather facilitate user interaction within a blockchain ecosystem.

What Are Some Real-world Use Cases For Utility Tokens?

Utility tokens have a wide range of applications, such as providing access to decentralized applications, digital content, voting rights, loyalty programs, and more. They enable users to participate and engage within a platform’s ecosystem.

Are Security Tokens Regulated Differently Than Utility Tokens?

Yes, security tokens are subject to securities regulations, as they represent ownership or profit rights. Utility tokens, depending on their specific use case, may be subject to different regulatory frameworks or exemptions.

Conclusion

Security tokens and utility tokens serve distinct purposes in the digital asset realm. While security tokens represent ownership or profit rights, utility tokens offer access within a platform. Understanding these key differences is vital for investors and businesses navigating the evolving landscape of tokenized assets.

Choose wisely!