Stablecoin investing is a safe option for risk-averse investors seeking stability and liquidity. By opting for stablecoins, investors can mitigate the volatility often associated with traditional cryptocurrencies.

In the fast-paced world of cryptocurrency investment, stablecoins offer a reliable and low-risk alternative for those who prioritize capital preservation. These digital assets are designed to maintain a steady value by pegging them to fiat currencies, commodities, or other stable assets.

With their stable value and reduced price volatility, stablecoins provide investors with a secure haven in the turbulent crypto market. Whether used for diversification or hedging against market fluctuations, stablecoin investing is a strategic choice for risk-averse individuals looking to safeguard their investments.

Understanding Stablecoins

Definition Of Stablecoins

Stablecoins are a type of cryptocurrency that is pegged to a stable asset, such as fiat currency or physical commodities like gold. The primary purpose of stablecoins is to minimize the volatility usually associated with other cryptocurrencies, making them an attractive investment option for risk-averse investors.

Types Of Stablecoins

There are several types of stablecoins which include:

- Fiat-backed stablecoins

- Commodity-backed stablecoins

- Cryptocurrency-backed stablecoins

Benefits Of Stablecoin Investing

Investors who are risk-averse can benefit from stablecoin investing, as stablecoins provide a secure and low-volatility option in the cryptocurrency market. By using stablecoins, investors can hedge against market fluctuations and diversify their portfolio effectively.

Reduced Volatility

Investing in stablecoins helps minimize price fluctuations, ensuring a steady value for risk-averse investors. —Liquidity And Stability

Stablecoins offer high liquidity and price stability, providing a secure investment avenue for risk-averse individuals.Factors To Consider

When it comes to stablecoin investing for risk-averse investors, there are several important factors to consider. These factors can help ensure that your investment is secure, reliable, and compliant with regulatory requirements. In this section, we will discuss two key factors: Security and Safety and Regulatory Environment.

One of the most critical factors for risk-averse investors is the security and safety of their stablecoin investments. Since stablecoins are designed to maintain a stable value, it is essential to choose a stablecoin that has robust security measures in place to protect your investment.

When evaluating the security and safety of a stablecoin, consider the following:

- 1. The underlying technology: A secure stablecoin should be built on a reliable and audited blockchain platform, such as Ethereum or Stellar.

- 2. Smart contract audited by a reputable third party: Look for stablecoins that have undergone a thorough smart contract audit to ensure that there are no vulnerabilities or coding errors that could put your investment at risk.

- 3. Transparent and audited reserves: A trustworthy stablecoin should provide regular, transparent audits of its reserves. This ensures that the stablecoin is fully backed by the appropriate collateral, such as fiat currency or other assets.

- 4. Multi-signature wallets: A stablecoin that uses multi-signature wallets adds an extra layer of security by requiring multiple private keys to access funds. This helps protect against hacking or theft.

By considering these security measures, you can significantly minimize the risk of your stablecoin investment and ensure the safety of your funds.

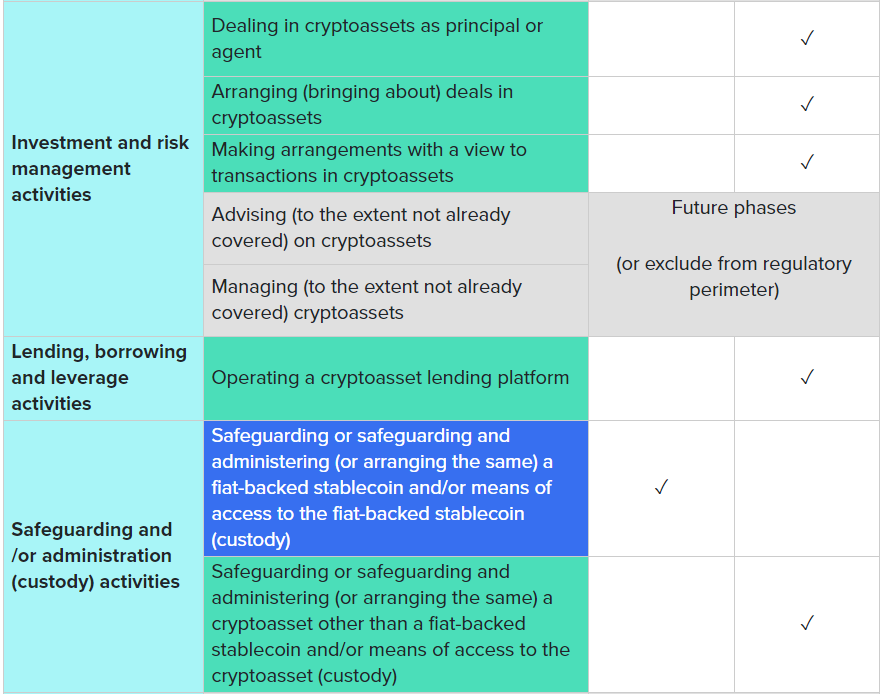

The regulatory environment surrounding stablecoins is a critical consideration for risk-averse investors. It is essential to choose a stablecoin that operates within the legal framework and complies with relevant regulations.

When looking at the regulatory environment, here are a few factors to consider:

- 1. Regulatory oversight: Look for stablecoins that are supervised or regulated by reputable financial authorities. This oversight helps ensure that the stablecoin adheres to the necessary legal and compliance requirements.

- 2. Government support or recognition: Some stablecoins may have obtained official recognition or support from governments or central banks. This can provide an additional level of confidence in the stability and legitimacy of the stablecoin.

- 3. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations: A reliable stablecoin should have robust AML and KYC measures in place to prevent illicit activities and promote transparency.

By investing in a stablecoin that operates within a secure and regulated environment, you can mitigate potential risks and ensure that your investment aligns with legal requirements.

Credit: unipayment.io

Top Stablecoins For Investment

When it comes to stablecoin investing, risk-averse investors seek stability and security. Here are the top stablecoins worth considering:

Tether (usdt)

Tether (USDT) is a popular choice among investors due to its 1:1 peg to the US dollar, providing stability in a volatile market.

Dai (dai)

Dai (DAI) offers a decentralized stablecoin alternative, backed by collateral assets to maintain its value, making it an attractive option for risk-averse investors.

Pax Gold (paxg)

Pax Gold (PAXG) stands out as a stablecoin asset backed by physical gold, offering a secure investment avenue for those seeking stability and long-term value.

Risk Mitigation Strategies

Stablecoin investing offers a more secure option for risk-averse investors. To maximize returns while minimizing risk, it is essential to understand risk mitigation strategies when it comes to stablecoin investments. Utilizing stablecoins for diversification and hedging against market volatility are key strategies that can help investors safeguard their assets.

Using Stablecoins For Diversification

Diversifying an investment portfolio is a fundamental risk mitigation strategy. By investing in a variety of stablecoins, investors can spread their risk across different assets and mitigate the impact of market fluctuations on their overall portfolio. Utilizing stablecoins for diversification provides a safety net against the volatility of traditional cryptocurrencies, offering stability and security in the face of market uncertainty.

Hedging Against Market Volatility

Market volatility can pose a significant risk to investors. Hedging with stablecoins provides a way to counteract this risk. By allocating a portion of their investment in stablecoins, investors can cushion their portfolio against the potential downsides of market fluctuations. This strategy allows risk-averse investors to mitigate the impact of price volatility in traditional cryptocurrency markets while maintaining a more stable asset base.

Credit: medium.com

Stablecoin Investment Platforms

Stablecoin investment platforms are an ideal choice for risk-averse investors looking for stability and security in their cryptocurrency investments. With low volatility and reliable returns, these platforms provide a secure option for those seeking a safe investment opportunity.

Investing in stablecoins can be an appealing option for risk-averse investors seeking stability in their investment portfolios. One of the key aspects of stablecoin investing is choosing the right platform to facilitate your investment activities. There are several stablecoin investment platforms available, each with its own set of features and considerations to keep in mind. In this section, we will discuss important factors to consider when evaluating stablecoin investment platforms.Security Considerations

When selecting a stablecoin investment platform, security should be a top priority. Look for platforms that implement robust security measures, such as multi-factor authentication, encryption protocols, and cold storage for funds. It is crucial to ensure that the platform has a strong track record of safeguarding user assets and maintaining airtight security practices.Platform Diversity

Diversity in investment options is essential for minimizing risk and maximizing opportunities. A reliable platform should offer a diverse range of stablecoin investment options, including popular stablecoins like USDT, USDC, and DAI, as well as emerging stablecoin offerings. This diversity enables investors to tailor their investment strategies to align with their risk tolerance and market outlook. In addition to the investment options available, platform diversity should also encompass factors such as user interface, liquidity, and support for various trading pairs. A well-rounded platform provides investors with the flexibility to navigate the stablecoin market effectively and capitalize on potential opportunities. Overall, choosing the right stablecoin investment platform is a crucial decision for risk-averse investors. By prioritizing security and seeking out a diverse range of investment options, investors can position themselves for long-term stability and growth in the rapidly evolving stablecoin market.

Credit: www.lexology.com

Frequently Asked Questions Of “stablecoin Investing For Risk-averse Investors”

What Is The Safest Stablecoin To Use?

The safest stablecoin to use is Dai (DAI), Tether (USDT), or Pax Gold (PAXG), offering reliability and stability for investments.

Why Use Stablecoins Instead Of Fiat?

Stablecoins offer stability and security, unlike fiat prone to inflation and volatility.

Which Stablecoin Is Best To Invest In?

When looking to invest in stablecoins, consider Dai, Tether (USDT), and Pax Gold (PAXG). These are popular options.

What Is The Point Of Investing In Stablecoins?

Investing in stablecoins provides a way to avoid the high volatility of popular cryptocurrencies like Bitcoin. It offers stability for common transactions and can be used as a diversification tool or to hedge against market risks. Stablecoins aim to be less volatile than other cryptocurrencies.

Conclusion

Stablecoin investments offer stability and security for those averse to risks. Diversifying your portfolio with stablecoins can help safeguard against market volatility. Consider stablecoin options like Dai, Tether, and Pax Gold for a secure investment strategy. Secure your crypto assets with stable value funds for peace of mind.